Dividends payable to a policyowner are strictly regulated – Dividends payable to policyowners are strictly regulated, ensuring fairness, transparency, and protection for policyholders. This article delves into the regulatory framework, calculation methods, impact on policyholders, ethical considerations, and industry trends shaping this crucial aspect of insurance policies.

1. Regulatory Framework

Dividends payable to policyowners are subject to a comprehensive regulatory framework that ensures their fair and equitable distribution. Regulatory bodies, such as insurance commissions and financial regulators, play a crucial role in overseeing dividend payments and ensuring compliance with applicable laws and regulations.

Specific Regulations and Laws

- Insurance laws in many jurisdictions mandate that dividends be calculated fairly and reasonably, based on actuarial principles and sound financial practices.

- Regulations often specify the minimum dividend interest rate or the formula used to calculate dividends.

- Securities laws govern the disclosure of dividend information to policyowners and investors, ensuring transparency and accountability.

Role of Insurance Commissions

Insurance commissions are responsible for regulating the insurance industry and ensuring compliance with regulations. They review dividend calculations, investigate complaints, and take enforcement actions when necessary. Commissions also provide guidance to insurers on best practices for dividend distribution.

2. Dividend Calculation Methods

The calculation of dividends payable to policyowners involves various methods, each with its own unique characteristics and implications. Factors such as policy type, performance, and investment returns influence the dividend calculation process.

Traditional Methods

- Contribution Method:Dividends are allocated based on the policyholder’s contributions to the insurance pool.

- Experience Method:Dividends are determined by the actual experience of the insurance pool, including claims and investment returns.

Modern Methods, Dividends payable to a policyowner are strictly regulated

- Risk-Based Method:Dividends are calculated based on the individual risk profile of the policyholder.

- Stochastic Method:Dividends are determined using statistical models that simulate future scenarios and investment returns.

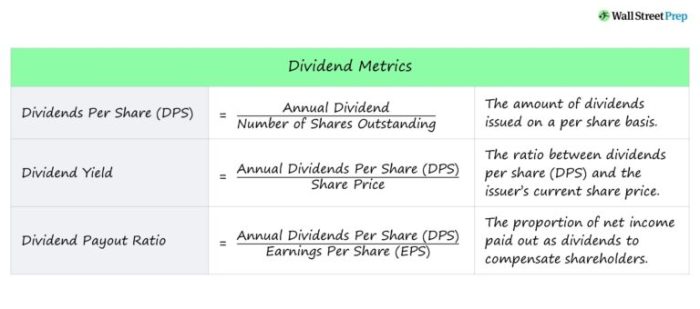

Formula and Models

Specific formulas and models are used to calculate dividends based on the chosen method. These formulas may include factors such as policy duration, premium payments, investment income, and claims experience.

3. Impact on Policyholders

Dividend payments can have a significant impact on policyholders’ financial well-being. Dividends provide additional cash flow, investment opportunities, and potential financial security.

Benefits of Dividends

- Increased cash flow for policyholders to meet financial obligations or invest.

- Enhanced investment opportunities through the reinvestment of dividends.

- Potential for reduced premiums or increased policy benefits.

Drawbacks of Dividends

- Reduced policy value or future benefits if dividends are not reinvested.

- Potential for lower dividends or dividend suspension during periods of poor financial performance.

- Complexity and variability of dividend calculations can make it difficult for policyholders to understand and plan for future dividends.

4. Ethical Considerations

Dividend payments in the insurance industry raise ethical considerations regarding potential conflicts of interest between insurers and policyholders.

Conflicts of Interest

Insurers have a fiduciary duty to act in the best interests of policyholders. However, the desire to maximize profits or attract new business may lead to conflicts of interest when it comes to dividend distribution.

Transparency and Disclosure

Transparency and disclosure are crucial for ethical dividend practices. Insurers must provide clear and accurate information about dividend calculations, assumptions, and potential risks to policyholders. This enables policyholders to make informed decisions about their dividend options.

5. Industry Trends and Innovations

The regulation and distribution of dividends payable to policyowners are evolving with emerging trends and innovations.

Technology and Data Analytics

Technology and data analytics are being used to enhance dividend calculations and transparency. Insurers can leverage data to better understand policyholder risk profiles, optimize investment strategies, and provide personalized dividend projections.

New Approaches to Dividend Distribution

Insurers are exploring new approaches to dividend distribution that meet the evolving needs of policyholders. These approaches include variable dividends, performance-based dividends, and hybrid dividend models that combine traditional and modern methods.

Question & Answer Hub: Dividends Payable To A Policyowner Are Strictly Regulated

Are dividends guaranteed for policyholders?

No, dividends are not guaranteed and depend on factors such as policy performance, investment returns, and regulatory approvals.

How are dividends calculated?

Dividends are typically calculated using formulas that consider factors such as policy type, premiums paid, and investment returns.

What are the benefits of receiving dividends?

Dividends can provide additional income, reduce policy costs, or increase policy value.

What are the potential drawbacks of dividend payments?

Dividend payments may reduce policy value or future benefits if not managed properly.